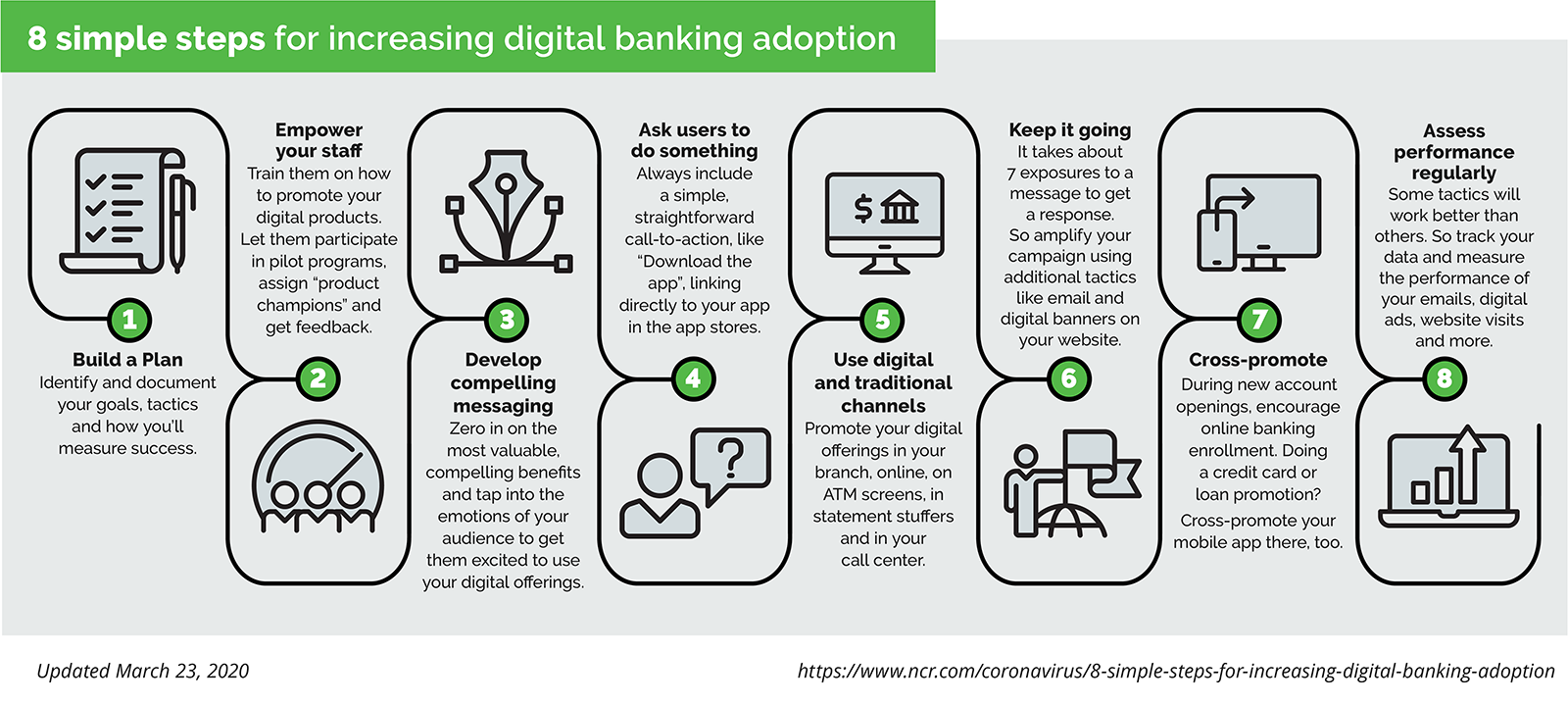

8 simple steps for increasing digital banking adoption

During a time of increasing social distancing, digital banking is especially key to staying connected with your bank or credit union customers while giving them an easy, no-contact way to handle their day-to-day banking tasks.

Below are eight simple steps you can use to increase engagement with digital banking. These provide you with key considerations—from planning to execution and everything in between—for gaining loyalty and maximizing profitability.

You can also download this guide here.

1. Build a plan

Whether your goal is to increase awareness of your digital banking platform, or drive adoption of key features that improve retention and boost revenue—it’s important to start with a comprehensive plan. Document your goals, identify which tactics you’ll employ to help achieve those goals, and determine how you’ll measure success.

HOW WE CAN HELP

Financial institutions using NCR Digital Banking can tap into our complimentary Lifecycle Marketing Program as well as comprehensive training for our products and services. We also offer staff readiness materials for select features—to help build internal advocacy.

2. Empower your staff

Before introducing a new feature to your customers or members, create awareness and build advocacy among your frontline staff. Engage them, train them and consider letting them participate firsthand through pilot programs. Make sure they’re aware of the benefits so they can confidently speak to and promote them.

Along the way, gather feedback from your staff and document questions to help you develop in-product FAQs for your users. Assign internal “product champions” who know the product well and can serve as a go-to for other staff who may have questions.

3. Develop meaningful, compelling messaging

Consumers see thousands of messages a day which means your messages risk getting lost in that sea of thousands (along with all the ads from other banks and credit unions).

So, if you want your digital capabilities to stand out, focus on the benefits. What do users really want? What benefit can they not live without? How do you give that to them?

Consider an ad about cloud photo storage. Which of the below is more compelling? “50 Gigs of Storage Space” or “Save up to 10,000 of your cherished photos.”

When it comes to your digital banking capabilities, zero in on the most valuable, compelling benefits—and focus on that as your starting point. Tap into the emotions of the reader.

HOW WE CAN HELP

With Lifecycle Marketing, we deliver targeted offers through online and mobile banking, and beyond – on your behalf, at no cost.

In addition, we offer free, pre-made, customizable “do it yourself” marketing campaigns that financial institutions can download, brand and launch on their own.

4. Ask your users to do something

If you’re going to ask for someone’s attention, command it—then reward that attention. Your marketing material should always include a simple, straightforward call-to-action.

A call-to-action is the part of your marketing message that tells the reader what they should be doing next. It should be direct, informative, and start with a command verb. A simple example is: “Download our mobile app” with graphics of the app store badges included (and in digital assets, linked directly to your app in the respective app store).

HOW WE CAN HELP

Use NCR Admin Platform to customize your navigation to include links to your social media pages like Facebook and Twitter.

5. Leverage digital and traditional channels

The more frequently a person sees a message, and in more places, the more likely they are to engage and take action. Maximize awareness by promoting your message across channels. Promote them in your branch and online, on your ATM screens and in your call center.

6. Keep it going

Once you’ve launched your marketing plan, keep it going. The principle behind the old marketing adage is that it takes seven exposures to a marketing message before a prospect will respond.

The more times someone sees your message, the more likely they will be to remember it. So, make it easy for people to see your message by continuing to promote it everywhere. Talk about your digital banking capabilities online and in person. Create an email campaign to remind users to download the mobile app and use it. Create in-branch signage or deploy digital banner ads at the top of your website to promote a new feature.

That’s the amplification effect. And it can really boost adoption.

7. Cross-promote

Find ways to cross-promote digital banking. For example, during your new account opening process, encourage enrollment in online banking. Or, if your bank or credit union is doing a credit card promotion, use that as an opportunity to cross-promote your mobile app.

With the right design and minimal messaging, you can get two messages in the space of one.

HOW WE CAN HELP

NCR can help you gain insights into user behavior, adoption, and more. NCR Admin Platform enables financial institutions to view and download detailed digital banking adoption and usage reports, on-demand.

In addition, NCR Profitability Analysis is a free service that scientifically analyzes your online and offline users to calculate your retention rates, account ownership, channel touch points, and other key metrics.

8. Assess Performance Regularly

Track your data. Every financial institution’s customer base is different, and some tactics work better than others. Make sure to regularly assess the performance of your ads, emails, and visits to your dedicated webpage. Stay flexible and modify where needed.

Remember, there’s a lot of noise out there in the market, and a lot of competition (not to mention shrinking attention spans). So, try using tips like these to generate and keep the attention on your digital banking capabilities to drive adoption and engagement—and help you meet your goals.